How to Calculate SaaS Pricing: 6 Models to Follow

Mar 03, 2023

How much thought have you put onto pricing your product? Be honest…

Here’s what most SaaS founders do

- Pick 3 pricing tiers that “feel right” and stick a 7-day or 14-day free trial in front of it; or

- Copy competitors’ pricing and feature sets exactly

If that’s you, make sure you read this post to the end. You’re probably leaving a lot of money on the table, and I hate seeing that happen.

Unfortunately most SaaS entrepreneurs (a) undercharge for their product and (b) spend a lot of time and money building new features, despite never increasing pricing.

(Note: you can skip straight to my “suggested approach” if you like, but it will make more sense if you get a sense of context first.)

The 6 Main SaaS Pricing Models: Which one Fits Your Business?

Yeah, you could just pick 3 pricing tiers that “feel right” and slap a 7-day or 14-day free trial in front of them. But there’s a method to the madness here.

Or rather, 6 potential methods you could use if you wanted to be more intentional with this, and ensure you’re charging what you’re worth while keeping as many customers as possible in the long term. Let’s outline them.

1. Competitor-based pricing:

Take a look at your competitors. How do they structure their pricing? What are their price points? Which features do they offer at each pricing tier? Or - if those tiers are based on usage rather than features - what are the usage thresholds for each tier?

It’s very tempting to just copy your competitor’s pricing exactly - and then undercut them by $5-$10 a month. Makes sense right? You’re offering everything your competitors have, but for a better price. Customers should flock to buy your product instead.

…but whatever you do, don’t fall into that trap.

Instead, look at your competitors as a ballpark range, but not as the perfect guide to be followed exactly. After all, they’re likely still figuring out their pricing as well and more than likely looking at yours for inspiration too.

All else being equal, it makes sense to put more faith in the pricing of your established competitors compared to newer/early stage competitors. Remember, the more established your competitor is, the more they’ve tested and honed their pricing.

On the other hand, more established competitors may have feature sets that you can’t match yet, or serve a different market segment to you. So treat their pricing as a starting point, as inspiration rather than Gospel.

Tl;dr - Competitor-based pricing is a good starting point and for reference, but you probably want to move to a different pricing model later as your business becomes more established.

2. Cost-Plus Pricing

Cost-Plus pricing is a very simple pricing strategy borrowed from retail. You look at how much it costs you to serve each customer, then add a margin or markup on top.

Here’s how to calculate your SaaS pricing based on this model:

Say a user costs $20 a month to support, and you decide to charge a 25% margin on top ($5), your SaaS pricing package would start at $25 per month.

The common pitfall here is that SaaS founders forget to include all their costs, not just the variable or direct costs that apply per customer.

As in the previous example, let’s say your total variable costs per customer are $20 per month. But then you add up all your other fixed costs (salaries, rent etc) and divide that figure by the number of customers you have.

Let’s say that comes out to another $10 per month. That means our total cost per customer is actually $30, not the $20 we’d originally planned for.

This means that if our SaaS pricing tiers start at $25 per month, we’re actually losing money on every customer we get.

That might be ok in the short-term if we’ve raised some funding and our burn rate can support that. At least until we can acquire more customers or bump them up into higher pricing tiers. But long term, a price of $25 per month would not be sustainable.

Cost-plus pricing makes a lot of sense if you don’t have many competitors - both because you can’t use competitor’s pricing for reference, and also because you have a lot more freedom to charge whatever the market will pay.

But what happens if you’re in a competitive space and your competitors are all charging less than the margin you want to make?

i.e, what do you do if, in the above scenario, you need to charge $30 per month to break even, but all your competitors are charging only $25 per month? You have three options:

- keep growing, so that economies of scale kick in and your fixed costs shrink as a percentage of overall costs. If you had twice as many customers but all your fixed costs remained the same, you could break even at $25 instead of $30

- find a way to reduce costs. This may mean making some tough decisions like letting certain employees go, moving to a smaller office, or switching to cheaper software tools and services.

- differentiate your product, so that you can charge more. Which means moving to Value-Based Pricing

Tl;dr - Cost-Plus pricing makes sense when you are in a totally new field or have very few competitors, but it is not a useful model in mature, competitive niches.

3. Value Based pricing:

When it comes to SaaS pricing strategies, Value Based Pricing is generally what you want to aim for as it allows you to maximise revenue.

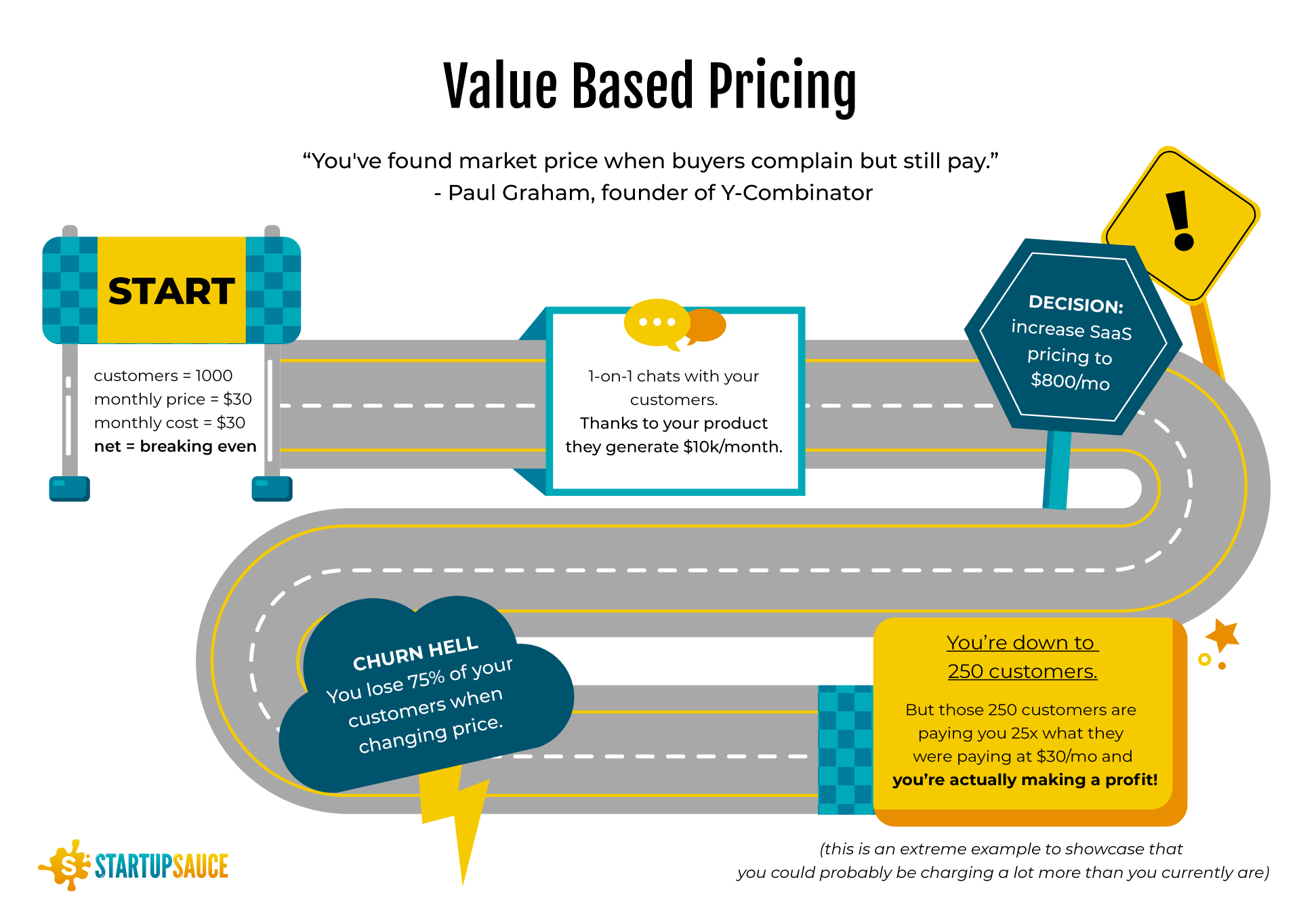

“You've found market price when buyers complain but still pay.”- Paul Graham, founder of Y-Combinator.

Talk to your customers about the value you provide and adjust the price of your product accordingly.

The downside of this approach is that it requires a lot of research and talking to customers - and if you get it wrong, it might hurt you overall.

See, if you go for value-based pricing, your prices are almost certainly going to increase, and that means some of your existing customers can’t or won’t pay the higher price. This depends on your market, and also on how competitive your space is.

How to Calculate your SaaS Pricing Based on Value

Let’s assume you have 1000 customers currently paying $30 a month, following the above example - it costs you $20 per month in direct costs, and that becomes $30 a month when you factor in all your other fixed costs like rent, salaries etc.

But each customer also costs $30 a month to support, so you’re only breaking even and not making any profit.

After talking to lots of your customers, you realise that your product is a godsend for them and helps them bring in lots of new customers each month, worth $10,000 on average.

So even though the cost to you is only $30 per month, the value to your customer is actually much higher: $10,000 per month.

Sure, your customers aren’t going to pay you more than $10,000. That would be nonsensical, they’d be losing money if they did. And they also have their own costs to cover as well - salaries, rent etc.

But maybe a lot of your customers would be willing to pay somewhere between $100-$800 per month, depending on the value they received from using your product.

That would still be profitable for them to do so, and there’s still enough surplus value generated for them to be happy investing time switching to your product, training their team members to use it, incorporating it into their workflows, integrating it with Zapier and their other tools.

If you charge $100/month, you’ll likely keep most or all of your customers…but you may still be leaving money on the table and not maximising your own revenue. You could probably charge some customers more and they’d be willing to pay it.

Let’s say you keep all your 1000 customers - but instead of paying $30/month, they’re all now paying $100.

If you charge $800/month, you’re probably going to lose quite a few customers. But the ones who stay are going to be paying substantially more.

Let’s say you lose 75% of your customers - a scary amount of churn for anyone. Now you’re down to only 250. But those 250 customers are now paying 8x more than they would at $100, and nearly 27x more than if you had kept the original price of $30/month.

Revenue: $800 * 250 customers = $200,000 per month.

Obviously this is an extreme example, but it does serve to show the stark difference between using cost-plus pricing vs value-based pricing. Assuming, of course, that your product is awesome and adds a lot of value.

4. Commission-Based Pricing

Commission-Based pricing is where you charge a fee on a per transaction basis, rather than on a recurring subscription basis (e.g. a monthly, quarterly or annual subscription.)

Commission-Based pricing is most commonly associated with marketplaces and financial services rather than SaaS. But in recent years the lines are blurring and many companies are using a hybrid of subscription-based and commission-based pricing - especially if your software product involves sending/receiving money or is usage-based and involves credits.

For example:

Shopify (an ecommerce SaaS) charges a transaction fee of between 0.5%-2% in addition to a monthly subscription (for stores that do not use Shopify’s own payment processing service).

Upwork (a talent marketplace) charges 3-20% transaction fees of revenue received by freelancers on the platform. In addition, freelancers can also sign up for the Freelancer Plus subscription at $14.99 per month, which gives them greater visibility and makes it easier to find clients.

Stripe (a payment processing platform) charges 2.9% + 30c for each transaction you receive. But they also use seat-based subscription pricing and usage-based subscription pricing for other products

Stripe Connect (Express or Custom plans): $2/month per active user account & 0.25% + 25c per transaction.

Stripe Sigma: starts at $10/month + 2c per charge for 0-500 charges per month, increases from their based on volume.

ZeroBounce (an email verification tool) offers both pay-as-you-go pricing starting at $0.08 per email (minimum spend works at out $16 per 2000 emails verified) as well as monthly subscriptions starting at $0.075 per email (which works out slightly cheaper at $15 per 2000 emails verified).

TestForTravel.com (started by a StartupSauce member and recently exited) primarily made money by displaying AdSense Ads, but also offered testing clinics the option of paying a monthly subscription for better visibility and higher placement in search results.

The main advantage of commission-based pricing is that your revenue grows as your customers grow. It’s possible to have expansion revenue without even acquiring more customers.

The downside is that such revenue is much harder to predict than recurring subscriptions This often makes it difficult to accurately forecast financial projections into the future - and thus make important decisions like when to hire additional people or how much runway you have left before you need to raise another round of funding.

For small companies or individuals, Commission-Based Pricing may seem very attractive as they don’t have to pay anything until/unless they see results. But then you’re taking all the risk, and that’s not always a smart idea.

The other major downside is that as a customer’s business grows, the commission revenue can start to feel egregious and they may resent it. So unless your product is very sticky and deeply embedded within their workflows, you may see a higher churn rate as a result. Worse, this churn is likely to be higher amongst your larger, more successful customers. And you don’t want that.

For these reasons it’s rare to see a SaaS company that uses purely commission-based pricing. A more common approach is to try to get the best of both worlds by combining a small commission pricing with a recurring subscription as well: you have the security of a recurring monthly payment plus a bite of the upside, but the commission is small enough not to fuel resentment and higher customer churn.

5. Per-Seat Pricing (aka Per-User Pricing)

This is where you charge a monthly subscription for each unique user of your software. This has some of the advantages of Commission-Based pricing (allows for expansion revenue as your customers grow), but is a better fit for companies that don’t facilitate transactions or use credits, or who want a more predictable revenue stream.

In my opinion, Per-Seat Pricing makes the most sense where you want to collaborate with other team members, but each team member is going to be using it differently, and you want different levels of access: E.g. admin sections for senior managers, and more limited access for individual contributors.

Per-Seat pricing also allows you to charge large enterprises a lot more money without scaring away smaller customers with pricing that looks scarily unaffordable. You could also do this by adding an Enterprise pricing tier that says “contact us for pricing” however.

For example, Slack offers two versions of Per-Seat Pricing:

Pro - $7.25 per user per month

Business+ - $12.50 per user per month

This is particularly effective for Slack because they also make very good use of Freemium and have a very robust Free plan. Once an organization starts using Slack for free and integrates it into their daily workflows, it’s very difficult to move to an alternative platform.

And suddenly when all your 1000 employees are using Slack and you need to upgrade, you’re staring down the barrel of a $7250-per-month subscription that’s only going to get more expensive as your company grows.

Per-Seat Pricing is pretty deceptive - it feels like great value, but at scale it can end up very expensive. I think per-seat pricing pairs well with a great freemium product (like Slack) as a result.

Similarly, Zoom, Calendly and Notion all offer Per-Seat Pricing, with different pricing tiers based on features as well as Forever-Free version.

I would not recommend Per-Seat Pricing for bootstrapped businesses. It seems to work best when paired with a Freemium model where the free version is excellent. Building such a product - and then waiting long enough for your free product to be so ingrained that your free users upgrade to a paid plan - is probably going to require millions of dollars in funding. If you’re VC-backed however, definitely consider this model.

6. Usage-Based Pricing

Usage-Based Pricing is similar to Per-Seat and Commission-Based Pricing in that you’re trying to charge a higher price for companies that have a greater need or ability to pay, without alienating non-power users.

Per-Seat Pricing makes sense when there are lots of potential users within an organization.

Commission-Based Pricing makes sense when there are lots of transactions and money being sent/received via your product.

Usage-Based Pricing, on the other hand, makes sense for companies where usage is measured in something other than money - GB of data sent/received/stored, Emails verified, Tasks run, Screenshots taken etc.

It’s common amongst utilities: your electricity bill, for example, is usually charged based on the number of Megawatt Hours (MWh) consumed.

The classic example within SaaS is Zapier (or their competitor Make, formerly Integromat).

Zapier is a tool that allows you to integrate different software tools together into automated workflows. A “Zap” or task occurs when data is transferred from one tool to another.

For example, when you find a prospect’s email address using SalesQL, and then it is automatically added to a Google Sheet via Zapier. That’s one Zap.

Zapier charges based on the number of “Zaps” processed per month - broken down into different pricing tiers, with the per-Zap price getting cheaper as you scale up the volume.

As with both Per-Seat and Commission-based Pricing, it’s rare to see a purely Usage-Based SaaS. More commonly you’ll see a hybrid approach, where there is a minimum monthly fee, or a recurring subscription charged in addition to usage.

Usage-Based Pricing has some overlap with Cost-Plus pricing too. Often you’ll see usage-based pricing where there is a significant variable cost component - essentially all you’re doing is adding a margin on top of the variable cost of providing the service, which then means that customers who use your product intensively pay more money than customers who use it more sporadically.

For this reason, any time you’d consider Cost-Plus pricing, it’s almost always a better idea to go the whole hog and use Usage-Based Pricing instead.

My Recommended SaaS Pricing Model Strategy

Unless you’re in a completely new field or have no established competitors, it’s best to avoid Cost-Plus Pricing altogether, it’s straight-up worse than everything else on this list in 99% of cases.

For most SaaS businesses - both funded and bootstrapped - it generally makes the most sense to start with Competitor-Based Pricing. At the very least, you know that some people are paying that amount of money for that set of features/usage.

Then, as your product matures and you gather more customer data you can gradually move to Value Based Pricing and try to capture more of the value you’re creating for your customers. You’ll likely lose some customers in the process, even if you follow best practices, but you should end up more profitable overall.

If your product is particularly sticky - i.e. your average customer lifetime is more than 2 years - you might then consider trying to get a slice of the upside by implementing Commission-Based, Per-Seat or Usage-Based Pricing.

If you’re funded, just choose whichever one is most appropriate for you: Commission-Based if money is involved, Usage-Based if there’s a huge discrepancy between power-users and others, Per-Seat if it makes sense for your customers to add all or most of their employees to your product.

If you’re bootstrapped, I’d probably avoid Per-Seat Pricing because it seems to work best combined with Freemium - and that’s generally a bad move for bootstrappers. At least initially. If you can make Per-Seat work without offering a Forever-Free tier, go for it.

Personally, I’d either stick with Value Based pricing, or combine it with either Commission-Based or Usage-Based pricing, depending on whether your SaaS involves sending/receiving money or not.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.